non resident tax malaysia

The withholding tax in Malaysia is an amount withheld by the party making payment payer on income earned by a non-resident payee. A concessionary tax rate of 10 for five years renewable for another five years will be given to a newly incorporated resident company in Malaysia that uses Malaysia as its international trading base for undertaking strategic sourcing procurement and distribution of raw materials components and finished products to its related and.

What Is Tax Residence And Why Does It Matter

In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes.

. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. This is the case if the overseas director spends only one day working in the UK during a tax year or if they visit the UK to attend a single board meeting in a year. It was suggested by James Tobin an economist who won the Nobel Memorial Prize in Economic SciencesTobins tax was originally intended to penalize short-term financial round-trip excursions into another currency.

A DTR will be accorded based on the lower of the foreign tax paid in Malaysia ie. In simpler terms if you are paying non-local foreign vendors you need to withhold a certain of the invoiced amount and pay to LHDN as a form of tax and the remaining. The Malaysia tax payable in respect of income derived from Malaysia shall be allowed as a credit against Singapore tax payable in respect of that.

By the late 1990s the term Tobin tax was being applied to all forms of. Malaysia is under the single-tier tax system. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

Withholding Tax Calculations for Non-Resident Public Entertainer. Dividends are exempt in the hands of shareholders. SPACEBAR resumes the slideshow.

The claim for DTR should be made when the. Legal framework Non-resident Indian NRI Strictly asserting the term says non-resident refers only to the tax status of a citizen who as per section 6 of The Income-tax Act 1961 has not resided in India for a specified period for the purposes of the Income Tax Act. Youll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents.

Capital gains generated from transfers of. A company is tax resident in Malaysia for a basis year if the management and control is exercised in Malaysia at any time during that basis year. For the most part individuals who stay in Malaysia for at least 182 days or more in a calendar year are.

You can also contact the CRA at the numbers listed at the end of this guide. Review the full instructions for using the Malaysia Salary After Tax Calculators which details. Non-UK resident directors of UK companies visiting the UK to perform duties associated with their board role are office holders so salaries or fees paid to them are subject to PAYE.

The empty string is the special case where the sequence has length zero so there are no symbols in the string. In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia. Payer refers to an individualbody other than individual carrying on a business in Malaysia.

A Tobin tax was originally defined as a tax on all spot conversions of one currency into another. Find the latest reporting on US. Malaysia adopts a territorial scope of taxation where a tax resident is taxed on income derived from Malaysia and foreign-sourced income.

Non-resident income tax NRIT rates. For non-residents income obtained without a PE is taxed at the following rates. The Jerusalem Post Customer Service Center can be contacted with any questions or requests.

Now youre ready to start filing your income tax. Hitting pauses the slideshow and goes back. Once you have logged in select Open a non-resident tax account from the menu.

You can change some of them if you need to especially if you. Income Taxes in Malaysia For Non-Residents. Non-Resident individual Knowledge Worker MT e-MT 4.

Hitting pauses the slideshow and goes forward. Non-resident taxpayers are subject to PIT at a flat rate of 20 percent on their Vietnam-sourced income. If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to https.

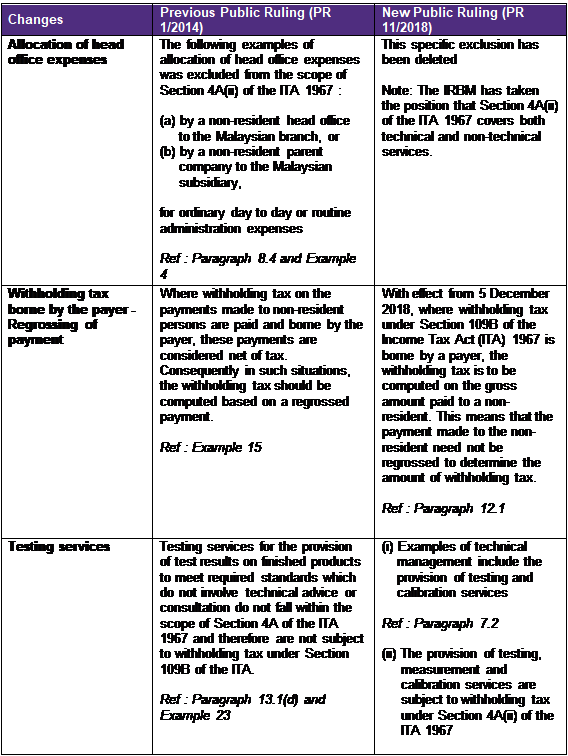

The general Withholding tax rate on technical fees paid to non-residents in Malaysia is 10 and the corresponding Singapore rate is the prevailing corporate tax rate which is presently 17. Youre now in slide show mode. The rates of income tax are different for persons who are resident in India and for NRIs.

Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Both resident and non-resident taxpayers are taxed only on income accrued in or derived from within Malaysia. You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia for less than 182 days in a year regardless of nationality.

Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia IRB. The first step is to review your personal details. 5 of the technical service fees and the Singapore tax payable on the service fees.

This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. For residents in other EU member states or European Economic Area EEA countries with which there is an effective exchange of tax information the rate is 19. Rental of movable property payment to a non-resident public entertainer or other payments made to non-residents which are subject to Malaysian withholding tax but where the withholding tax was.

Adapt to a changing business tax landscape and never miss an important detail with powerful insight into a broad collection of complex tax topics. If you have never remitted non-resident income tax deductions you can open a non-resident tax account online through My Account My Business Account or Represent a client. This amount has to be paid to LHDN.

The calculator is designed to be used online with mobile desktop and tablet devices. 2421 Extension 4 Jerusalem Post or 03-7619056 Fax. From working onboard a ship registered under the Merchant Shipping Ordinance 1952 and used for business operations by a resident owner is exempted from tax.

Exemptions of Income for Non-Resident Public Entertainer. Resident status and income tax in Malaysia. Authored by tax experts and created specifically for the web Thomson Reuters Checkpoint Catalyst gives you tax research tools and practical guidance for resolving tax questions that arise with.

However certain royalty income earned by a non-resident person may be exempted from tax. Tax residents are subject to PIT on their worldwide employment income regardless of where the income is paid or earned at progressive rates from five percent to a maximum of 35 percent. Income in respect of interest received by individuals resident in Malaysia from money deposited with the following institutions is tax exempt with effect from August 30 2008.

Residence Status Of Companies And Bodies Of Persons Main Criteria That Determines The Tax Treatment Asq

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

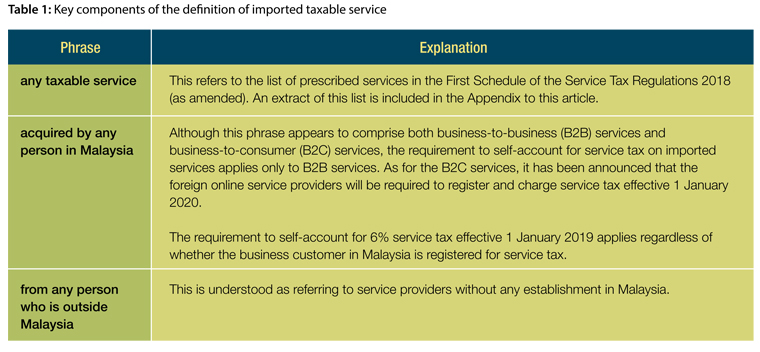

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today Malaysian Institute Of Accountants Mia

Tax Treatments Between A Resident Non Resident Company

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

What Is The Non Resident Income Tax Rate In Malaysia 2022 Wise Formerly Transferwise

How To Calculate Rental Income Tax For Non Residents Foreigner

Tax Alert Grant Thornton Malaysia

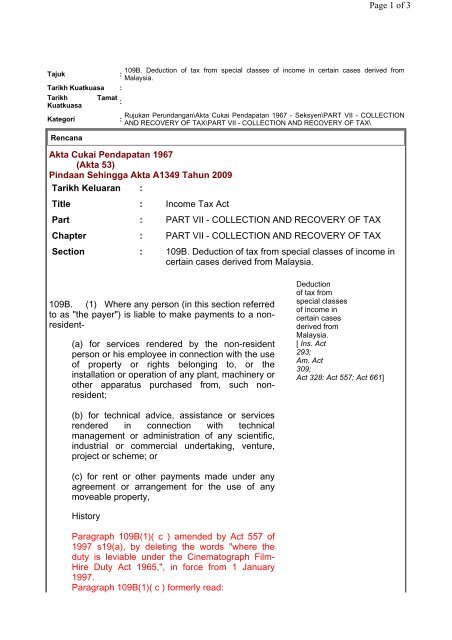

109b Deduction Of Tax From Special Classes Of Income In Certain

Taxplanning What Is Taxable In Malaysia The Edge Markets

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

Demystifying Malaysian Withholding Tax Kpmg Malaysia

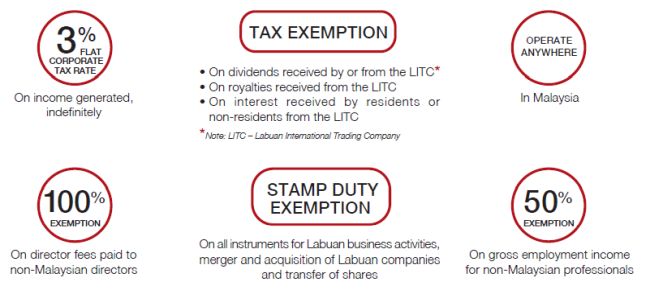

A Guide To The Gift Programme Commodities Derivatives Stock Exchanges Malaysia

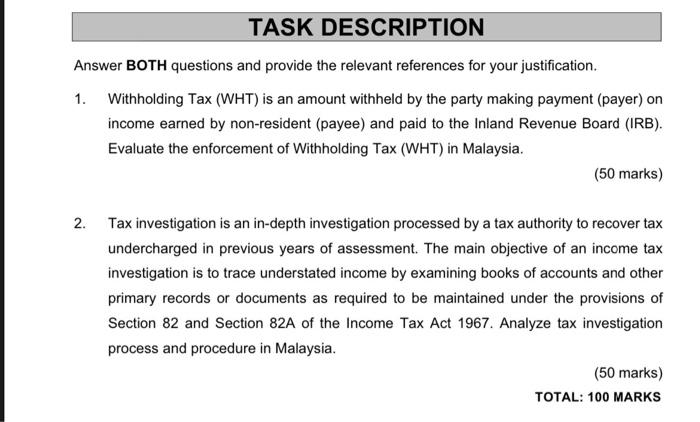

Solved Task Description Answer Both Questions And Provide Chegg Com

Malaysia Imposes 6 Dst On Non Resident Companies Vatglobal

Should Advertisers Pay Withholding Tax On Google Facebook Advertising In Malaysia Ecinsider

0 Response to "non resident tax malaysia"

Post a Comment